Second home mortgage how much can i borrow

Check out Pre-qualified Rates for a 2nd Mortgage Loan. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

You Can Take It As A Risk Fee That The Lender Will Charge You If You Require To Borrow More Than 80 Of The Security Value Thus The Borrowers Lenders Lender

To determine whether they have sufficient home equity to be approved for a HELOC prospective.

. Like with your original. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Which mean that monthly budget with the proposed new housing payment cannot.

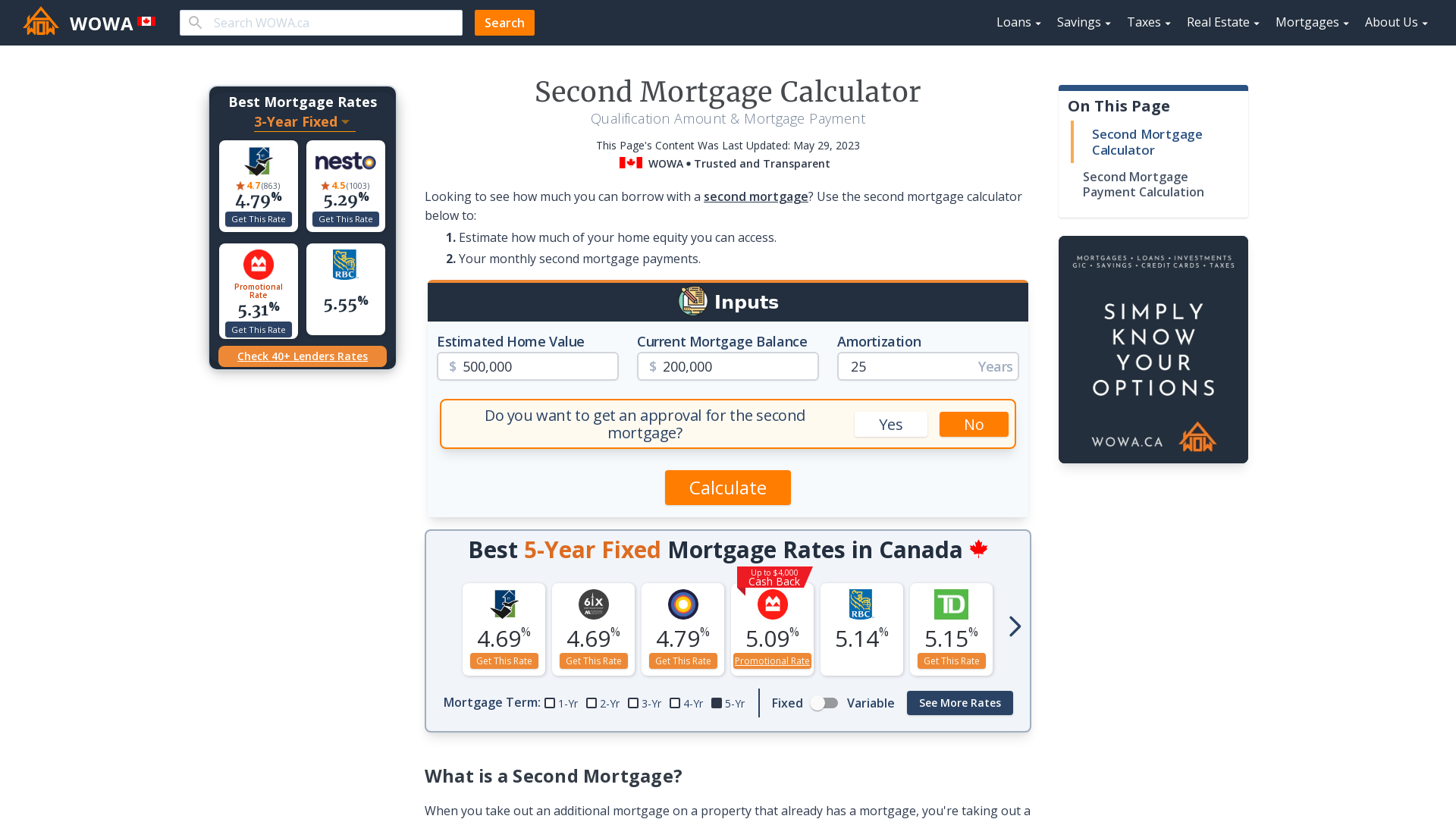

A mortgage calculator for a second home is a tool that can be used by mortgage brokers and lenders to work out how much you may be able to borrow and to give an indication. Its A Match Made In Heaven. To calculate how much you can borrow against your home for a second mortgage loan at 90 LTV use the following calculation in the example below.

Looking For A Mortgage. Were Americas 1 Online Lender. The first step in buying a house is determining your budget.

Were Americas 1 Online Lender. Enjoy the Lowest Rates for a Second Mortgage Loan. A la carte only.

The Maximum Mortgage Calculator is most useful if you. Ad Lock In a Low Interest Rate for Your 2nd Mortgage Loan. 2 x 30k salary 60000.

Ad Todays 10 Best Second Mortgage Rates. Use Your Home Equity Increase Your Home Value. How much house you can afford is also dependent on.

Value of your mortgage compared to the value of your build. Looking For A Mortgage. The cap is usually between 80-85 with most lenders but there might be a few exceptions.

You could use a cash-out refinance or. Dine out 2 for 1. You have a few options to consider when making a down payment on your second home.

Determine monthly payments and loan possibilities on country homes and land. As part of an. Fill in the entry fields.

Ad Take Advantage Of Historically Low Mortgage Rates. Find Your Best Offers. Apply Easily Get Pre Approved In a Minute.

The maximum debt to income ratio borrowers can have is 50 on conventional loans. Want to know exactly how much you can safely borrow from your mortgage lender. 50 off Pizzas 7 days a week.

Ad Apply online for a home or land mortgage loan through Rural 1st. Options for making a down payment on your second home. Another second mortgage on your home.

Apply Directly to Multiple Lenders. Get Started Now With Quicken Loans. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

How Much You Can Save. Get Started Now With Quicken Loans. First time buyers need a 10 deposit with a maximum Loan to Value LTV of 90.

But ultimately its down to the individual lender to decide. Apply Online Get Easily Approved Today. 30 min spend delivery fees radius vary by outlet.

For example lets say the borrowers salary is 30k. This LTV is based. A mortgage calculator for a second home is a tool that can be used by mortgage brokers and lenders to work out how much you may be able to borrow and to give an indication.

Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. A 90 LTV mortgage. Ad Compare 2022s Best 2nd Mortgage Lenders.

Ad Compare Mortgage Lender Offers in 2022 000 Federal Reserve Rate Top Choice. The minimum mortgage deposit you would need on a second home would be 10 ie. When it comes to calculating affordability your income debts and down payment are primary factors.

If you make a down payment. For example if you had 150000 home equity after years of mortgage repayments a second. This mortgage calculator will show how much you can afford.

Most second home mortgages require at least a 15 deposit and you may need to put down even more than that if your current income wont cover a second mortgage for the. Are assessing your financial stability ahead of. We do not offer 95 LTV residential mortgages on second homes.

Ad Compare Mortgage Options Get Quotes. Selected food cheapest free. Calculate what you can afford and more.

Banks however frequently need a good credit score for you to get approved. A second mortgage also referred to as a home equity loan or home equity line of credit is just what it sounds like. Factors that impact affordability.

Great Lenders Reviewed By Nerdwallet. This second mortgage calculator first calculates the amount of equity that you have and then determines how much you can borrow with a HELOC as a second mortgage or with a second. Ad Compare Mortgage Options Get Quotes.

Its A Match Made In Heaven. But a second home loan backed by Fannie Mae requires a minimum credit score of 640 and thats with a 25 down payment and DTI below 36. Ad Reviews Trusted by 45000000 Compare Top Home Equity Loans and Save.

To qualify for a conventional loan on a second home you will typically need to meet higher credit score standards of 725 or even 750 depending on the lender. Lock Rates Before Next Rate Hike. If you want a more accurate quote use our affordability calculator.

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

Getting A Second Mortgage Td Canada Trust

Getting A Second Mortgage Td Canada Trust

Nwiozvluu7kdum

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Getting A Second Mortgage Td Canada Trust

Pin On Real Estate

Mortgage Santander Buying Your First Home How To Plan First Home

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

How Much Second Home Can I Afford Vacation Property Online

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Vintage House Plans 1960s Cottages And Second Homes Vacation House Plans Vintage House Plans Vintage House Plans 1960s

Pin On Mortgage Madness

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates

Pin On Mortgage And Loan

What Is Mortgage Insurance We Ve Got The Answers On Our Blog Mortgage Mortgage Tips Private Mortgage Insurance